How Market Uncertainty and Federal Reserve Tensions Impact Bond Investors

Similar to equity markets, heightened uncertainty has triggered fluctuations in bond markets. These movements, influenced by trade policies and tensions between the administration and the Federal Reserve, have driven interest rates and bond yields upward. Although short-term volatility can produce unexpected outcomes, it's worth noting that such periods emerge cyclically, even though the underlying causes vary each time. For fixed income investors, particularly those dependent on their portfolios for income streams, the present climate offers both difficulties and possibilities for their financial strategies.

Recent bond market turbulence has increased

A fundamental principle of portfolio diversification relies on the typical lack of correlation between stocks and bonds. Generally, when one moves in a particular direction, the other tends to move oppositely. This isn't coincidental – equities usually perform well during economic strength while bonds have traditionally excelled during economic uncertainty. This relationship explains why combining equities, fixed income, and alternative assets can create a more stable portfolio than holding just one asset class, enhancing the probability of meeting financial objectives.

What's occurring in bond markets now and why is it significant? Occasionally, financial market volatility creates exceptions to these historical patterns for brief periods. For example, bond volatility may emerge when markets adapt to major economic or policy shifts, such as today's developments regarding trade policies and questions about Fed independence. Regarding tariffs, bond investors are evaluating two potentially contradictory scenarios: trade conflicts might increase prices, which could be inflationary (typically negative for bonds), and/or they could decelerate economic expansion (typically positive for bonds).

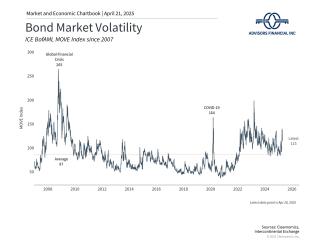

Additionally, concerns about liquidity, potential divestment from U.S. assets, and technical factors have contributed to recent movements. The dollar has also declined alongside bonds, which is unusual since higher bond yields normally attract international investors. The chart illustrates that bond market volatility has been elevated not just in recent weeks but throughout the past three years.

While these factors surround bond market fluctuations, they fundamentally represent increased policy uncertainty. Bond prices depend heavily not only on the future direction of interest rates and economic conditions but also on how unpredictable this trajectory might be. Just as recent governmental actions regarding trade have complicated planning for households and businesses, forecasting economic variables has become more challenging, whether for the coming months or year ahead. This includes Federal Reserve policy direction, exacerbated by headlines concerning President Trump and Chair Powell. Consequently, it's understandable that bond prices have fluctuated alongside stocks.

Fixed income investments continue to provide portfolio stability this year

Context remains important. Currently, the 10-year Treasury yield hovers around 4.3% – comfortably within its range over the past two years. Generally, interest rates are higher than many analysts anticipated at the beginning of the year.

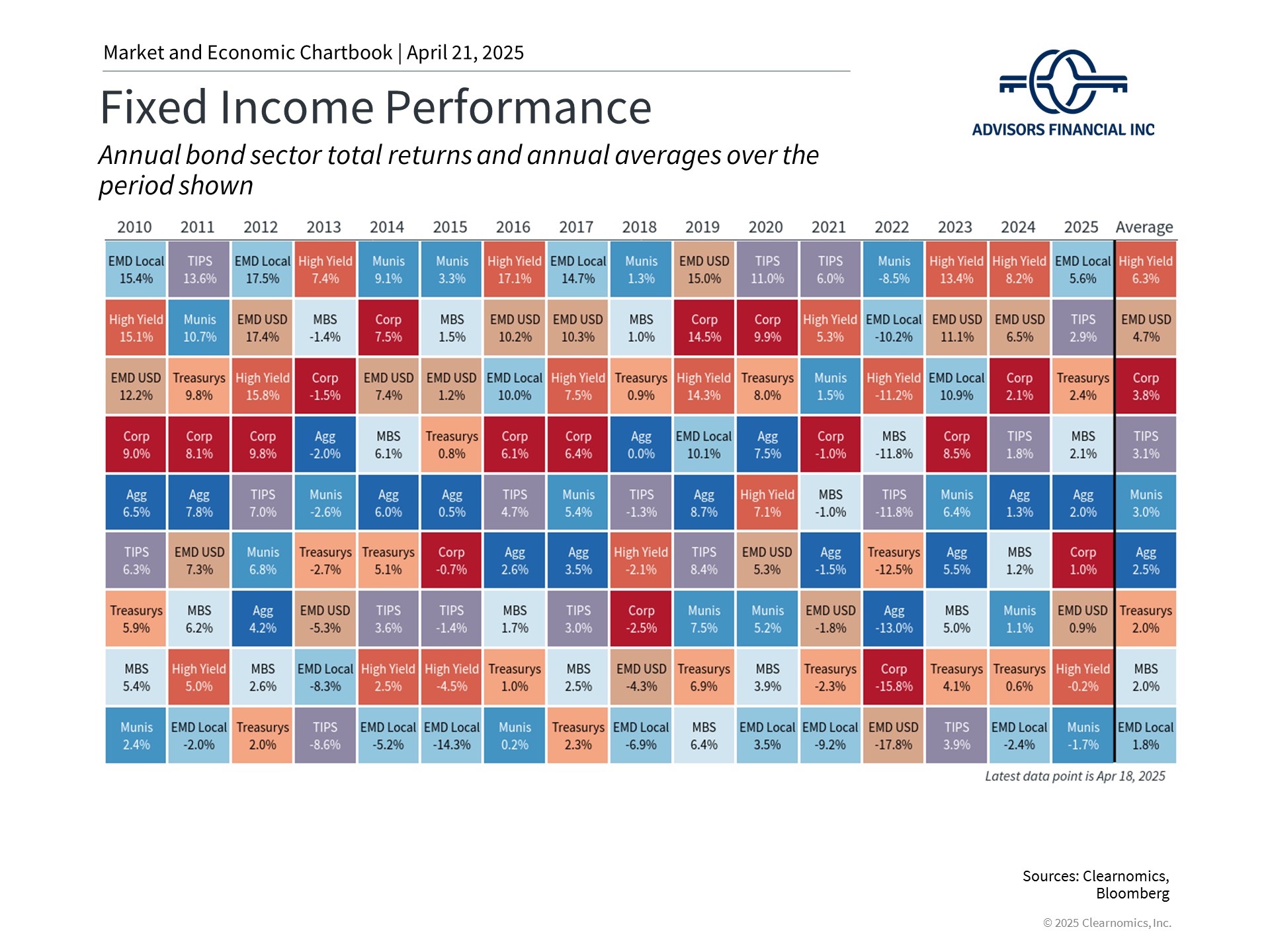

Nevertheless, most bond sectors still display positive year-to-date returns, including the U.S. Aggregate Bond Index, Treasurys, and investment grade corporate bonds. High yield bonds, which closely correlate with equity markets, show only slight negative performance.

As these returns demonstrate, corporate bond investors are distinguishing between higher and lower quality issuers amid persistent economic uncertainty. Corporate bond spreads, which indicate how much additional yield these instruments generate compared to Treasurys, represent one way to measure this distinction. Investment-grade spreads have remained relatively narrow, while high-yield spreads have expanded noticeably. Still, current spreads remain significantly tighter than during previous crises such as 2008, 2020, and 2022.

Municipal bonds have also experienced greater volatility recently. The muni ratio, which compares municipal bond yields to Treasury yields, increased following the tariff announcement and continues to remain elevated. This higher ratio indicates that municipal bonds present greater relative value compared to Treasurys today, especially for investors in higher tax brackets and high-tax states.

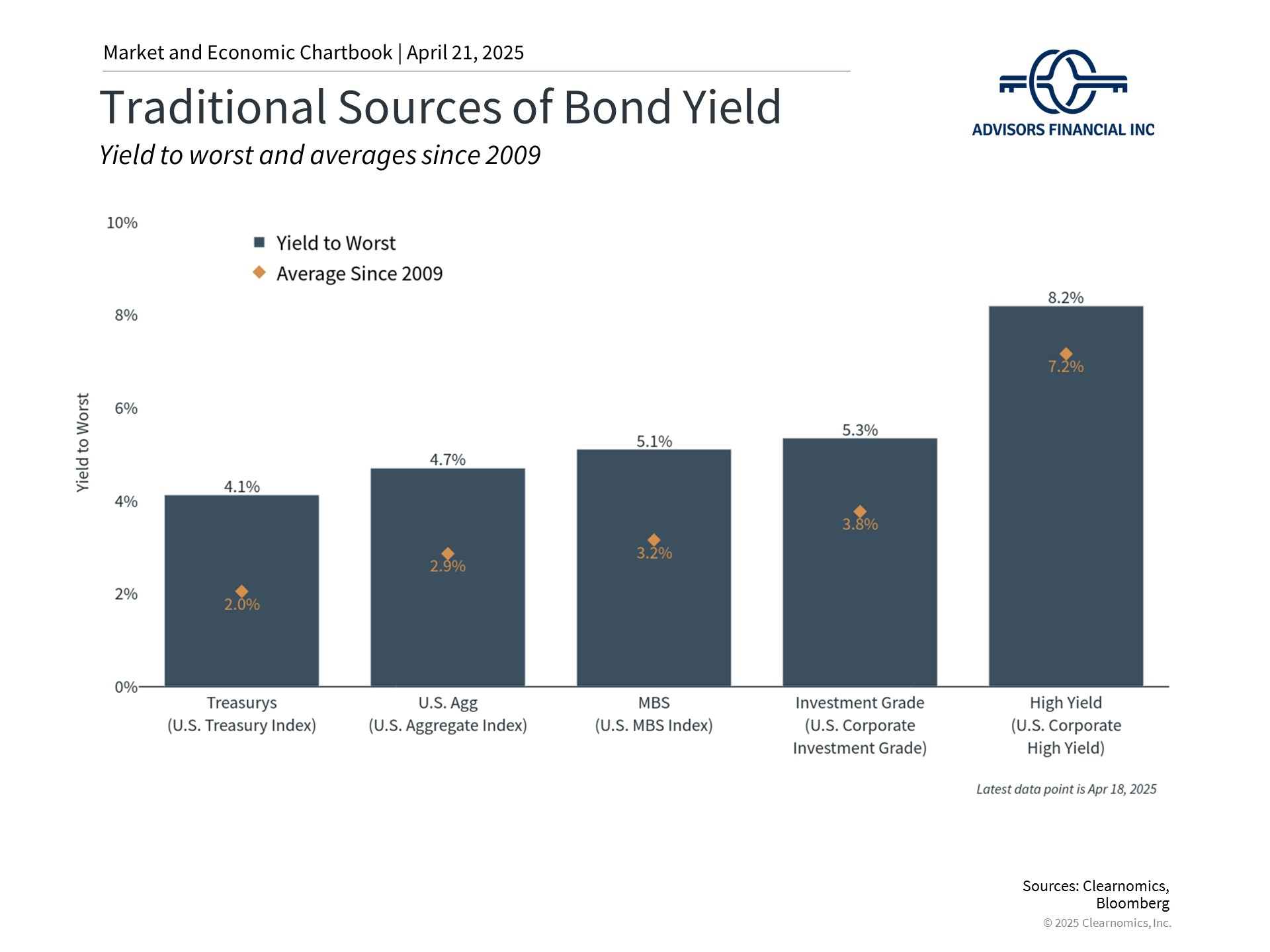

Bond yields remain at appealing levels

Regardless of how bond prices shift in upcoming weeks, yields remain attractive compared to the past two decades, creating opportunities across fixed income markets for those seeking portfolio income. Investment grade corporate bonds, for instance, currently offer an average yield of 5.3%, compared to a historical average of 3.8% since 2009.

The outlook for bonds may also be favorable as the Fed is anticipated to implement additional rate cuts later this year, regardless of how the disagreement with the White House evolves. For income-focused investors, current yields are appealing across numerous fixed income sectors and can support portfolios during ongoing market uncertainty.

The bottom line? Policy developments continue to unsettle financial markets. Despite recent bond market volatility, attractive yields and generally positive returns can help long-term investors achieve their financial goals.

April 22, 2025

Steve Tomisek, CFP® | Chief Investment Officer

Important Information

Advisors Financial, Inc. (“AFI”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where AFI and its representatives are properly licensed or exempt from licensure.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.